The short answer, for several reasons, is do it now! No amount of price reduction in solar panels will turn waiting into a good investment decision.

- Cash in your pocket and bank account today is worth more than next year or the year after – the time value, or “Present Value”, of money

- In the US, the Investment Tax Credit will drop by 4% in 2 years

- This includes the 2018 reduction in US corporate income taxes

- Reducing carbon emissions today is more valuable than tomorrow – the “Present Value of Carbon Reduction”

Building solar energy today is truly a triple-bottom-line winning proposition. Get a cup of coffee and stay with me for 5 minutes if you are curious about the explanation.

Every few months, a client asks whether they should invest in a solar-energy system now or wait a couple of years. This question comes up more often when something happens to the market – electricity prices go down (in some of our Caribbean markets) or there are tariffs on solar panels and other commodities.

Really the only way to answer this question is to crunch some numbers.

SAVINGS

Since solar energy is technology driven, the price will continue to come down as technology gets better and economies of scale improve the market. It is a good assumption that solar panel prices might drop 10% a year, or 20% in two years. This is the approximate rate that the industry has experienced since before 2010.

The rest of the system includes electronics and racking systems. These aren’t as costly as the panels, and haven’t been enjoying the same falling prices. The electronics are not new technology – data centers, for instance, have been using and improving inverters for many decades. Pricing on inverters has dropped maybe 20% since 2010.

Efficiency in that time might go up about 4% a year, again mirroring increases in the last half decade. This would reduce the cost for other parts and tasks that share in the total project cost, which translates to approximately another 1% annual cost reduction.

COST INCREASES

Offsetting those savings; the cost of fossil-fuel electricity will always go up over time, because of inflation and the cost of fossil fuels. The drop in the Caribbean from 2014 to 2016 is an anomaly and was a surprise to industry experts, although that drop has reversed and is trending upward again matching the price of West Texas Intermediate Crude on the commodities market. Typically, utility or fuel costs go up by 4% to 8% per year, depending on the market. Let’s assume 3% annual increase for this analysis, along with the same 3% increase in insurance and the cost of everything else including the installation labor.

TIME VALUE OF MONEY

Recall that a dollar today is worth more than that same dollar in a year. For everyone that was asleep during that part of math class, that’s the “discount rate”, or the “time value of money”. Most of our clients like to evaluate investments with a discount rate of 4%, so we will use this rate for our analysis. That means $100 today has the buying power of only $96 in a year, and so on.

TAXES

We will consider two scenarios: a project in the US and a project in the Caribbean. Our assumptions are that our US client will pay 27% combined Federal and State income tax (in 2018) and be able to depreciate the system on the 2018 expense schedule, and that our Caribbean client will pay no income tax and not be entitled to any depreciation. That isn’t the same for the OECS countries, but you will see through this article that the tax rate doesn’t really change the outcome.

INCENTIVES

Right now the US Investment Tax Credit (ITC) is in effect, representing a 30% first-cost reduction for buyers that are US taxpayers in US territories. The ITC doesn’t apply in the Caribbean (outside Puerto Rico or the US Virgin Islands). In two years, the ITC will drop to 26%, and then 22% the year after.

There also are state and local incentives, such as Solar Renewable Energy Credits. But since those vary by locale, these aren’t included. In any case, like the ITC, it is likely incentives will drop or disappear over time. So waiting one or two years puts the incentive benefit at risk also.

RESULTS

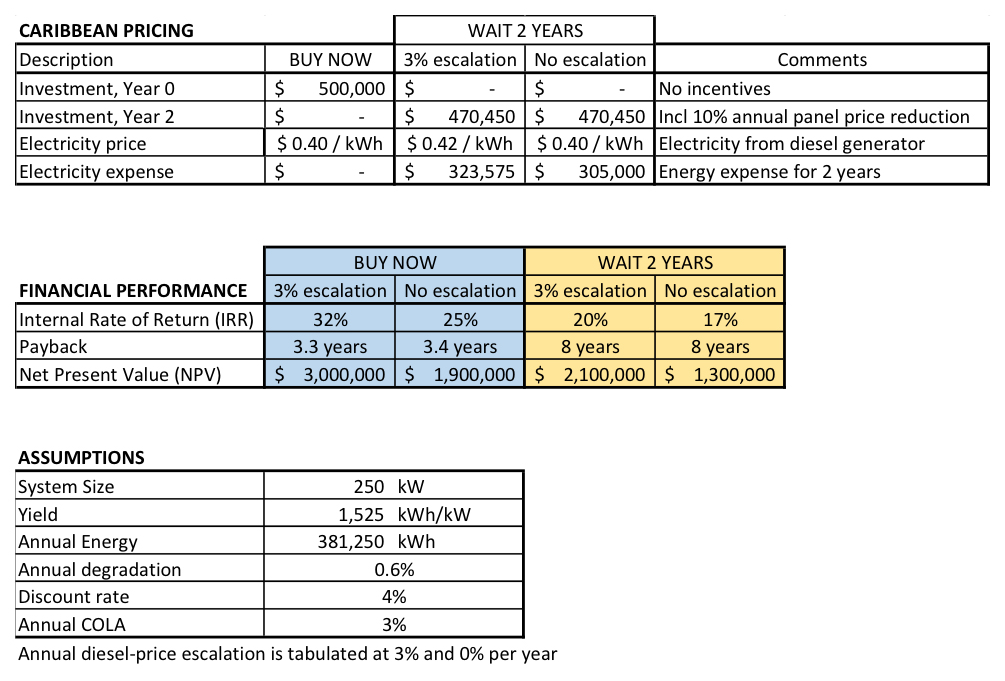

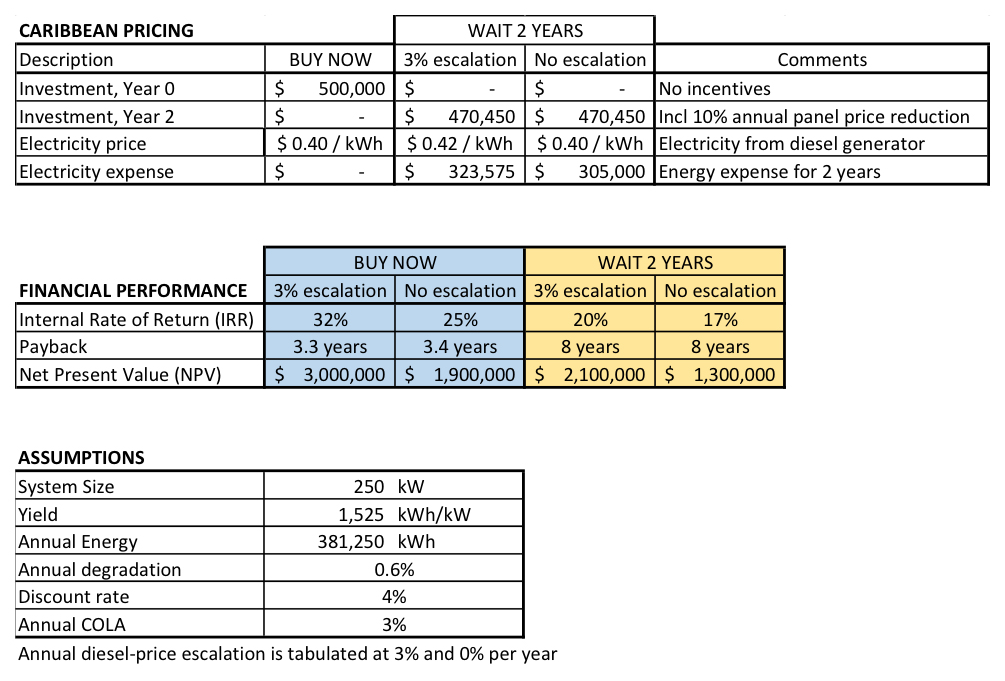

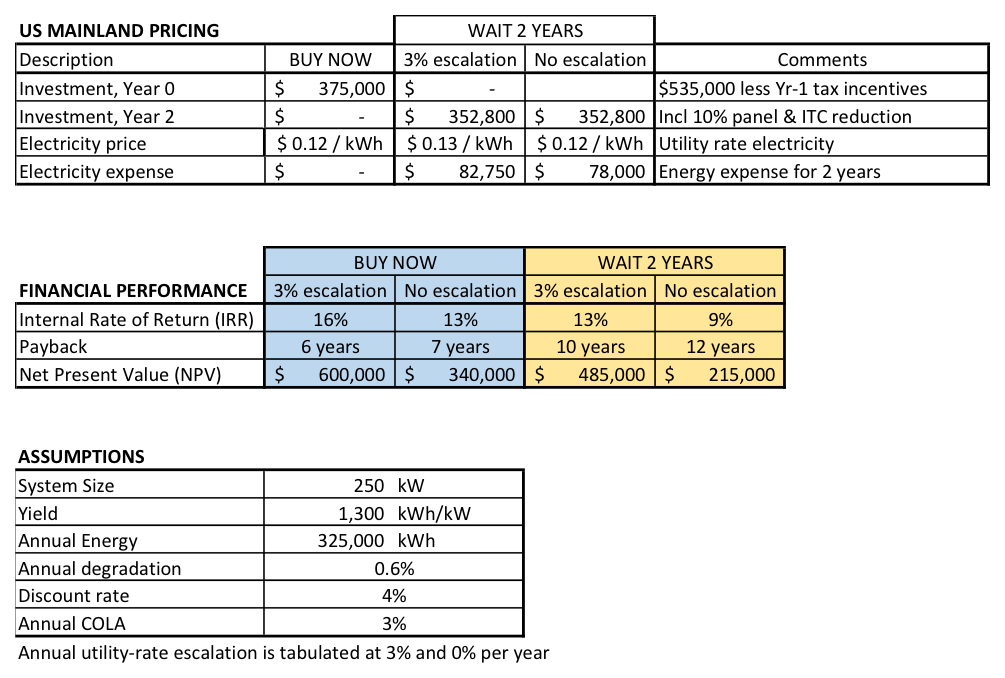

For the Caribbean and the US, the financial performance is much better when the project is put in service this year, rather than waiting two years! The performance resulting from waiting 2 years is still really good. But clearly it is not as good as investing now!

The table below shows the outcome of the analysis for the two scenarios. For the Caribbean scenario, investing in the project today delivers a return of 32% compared to an estimate of 20% resulting from waiting 2 years. The straight-line payback drops from 3.3 years to 8 years. The Net Present Value (NPV) drops from $3M to $2.1M.

Surprised?

How about the US project, where the model is subject to income taxes, capital asset depreciation, and the ITC, but also enjoys a much lower cost of utility energy. The US project put in service this year out-performs the project that is delayed by two years. Return of 16% compared to 13%, and straight-line payback of 6 years compared to 10 years.

Yes, there are a lot of assumptions in this model analysis. Costs and prices might vary more or less than these assumptions. But other than technology prices, anyone that buys goods or services will agree that prices always go up, and rarely go down.

A percent here, a percent there, up or down. How will those changes affect the sensitivity of this analysis? It is hard to tell, but can we all agree that solar panel prices will never be zero?

If so, consider this: even if solar panel prices went to zero in two years – manufacturers giving panels away and delivering them for free – it is still not possible to get better financial performance by waiting two years!

The return and payback will continue to be better than the tables above, but not good enough to overcome the financial losses that happen by delaying the decision and reducing energy expense this year.

It’s true. Ask us to share this analysis with you if you need to see the numbers.

Finally, let’s touch on the non-financial reasons to act now, because a solar-energy project delivers marketing advantages and environmental benefits on top of the excellent financial performance. Most marketing experts will agree that a marketing advantage today is more valuable than a marketing advantage in the future. A bird in the hand ….

The same thing holds for environmental benefits. Reducing fossil fuel consumption and carbon emissions starting today is more valuable to the planet than starting in the future. We call it the “time value of carbon reduction”! (Or the “present value of carbon reduction”.)

The reduction in energy and fuel costs that has been with us for 1-2 years in the Caribbean represents a good buying opportunity! (Even though prices have increased somewhat after the 2017 hurricane season.) Almost everyone that buys energy is spending less on energy this year as compared to two years ago. This is leaving more money on the table that can be invested in building improvements. Our savvy clients are taking advantage of this opportunity and kicking off their solar-energy projects that they have been thinking about for a few years.

No matter how you slice it, the smart money is going into renewable energy today – for your bottom line … and the bottom line of the planet.